War! What is it Good For?

Sunday Ramble

In last week’s Ramble, I jinxed myself in my glee at missing the huayco while we were in Brazil. Just yesterday, my daughter and I got caught in the flash flood as we tried to make our way back home via moto-taxi, rain pouring in through the open sides. The moto pulled up abruptly in front of a raging creek passing into the river we live near. The stream was supposed to be the road. However, I saw a local braving it, water lapping at his shorts, and it encouraged me to try as well — we were only a scant 500m from home. One trip across gave me the confidence to try again with our groceries and then a final time with my 3-year-old. It was either brave or stupid, but we survived.

Speaking of surviving, I’ve been watching the Ukraine and Russia situation play out, knowing that the problem is far too complicated for me to understand. My heart goes out to all those caught in the action. Watching a father saying goodbyes to his daughter and wife made their war hit too close to home. I honestly cannot, and hope never to, imagine what that choice must feel like.

The war activities kicked off on the same day that Sazmining, the company I’ve been working to progress, launched its new website. To say that I’m proud of the accomplishment, and the team that breathed it into being, is an understatement. Our vision is to transform the way people relate to money and energy. Our new platform, allowing any anywhere to purchase and mine Bitcoin with renewable power, is the first step in many along the journey. Even our current equity raise of $1M is going along swimmingly with several checks cut in the last month to help us further our vision — please do reach out if you happen to know someone interested in participating.

But it wasn’t lost on me that the same day we launched our platform, war was breaking out on the other side of the planet. So, announcing our step forward into the marketplace, I shared this message with our team:

Fulfilling our mission will make it much more difficult for governments to inflate money to pay for wars, bringing about a more peaceful planet for our children and grandchildren. Though we may be the few who still understand this, we will be judged as being on the right side of history with the actions we are taking, starting with this momentous leap forward today.

I believe we live through the era when money and state are separated. Just as the separation of church and state allowed democracy to flourish, there’s likely a new organizational structure awaiting humanity around the corner of separation of money and state. But just as the separation of church and state was met with tumultuous times taking decades, if not centuries, we find ourselves in similar historical cross-hairs. The route to the separation is circuitous and wild, but as long as the adoption curve of Bitcoin continues up-and-to-the-right, I cannot see how it’ll be stopped.

Indeed, knowing that Bitcoin, a mere 13 years into existence, is now a centerpiece of conversation in the unfolding Ukraine Russia conflict is enough to know that something unprecedented is occurring. Ukraine solicited funds via crypto, and several million dollars were donated within a few hours.

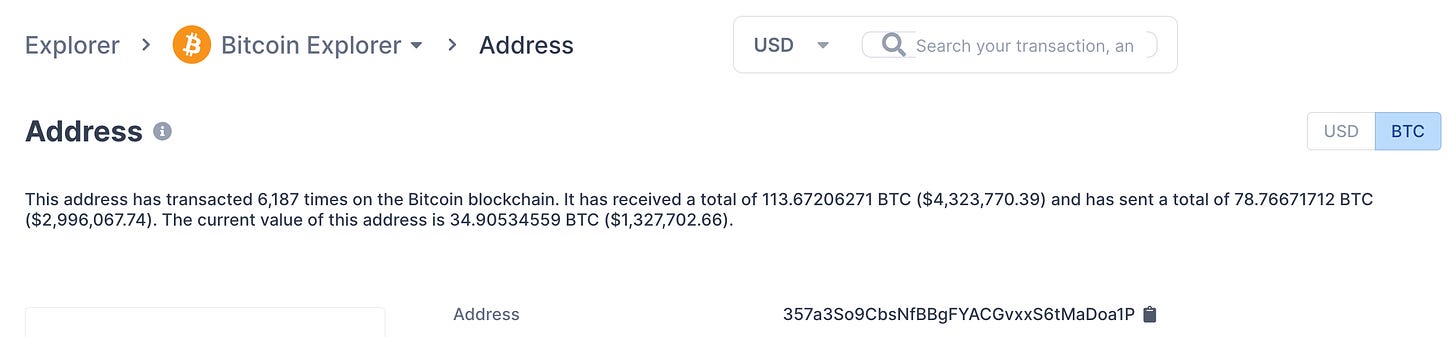

The joy of the blockchain is that the world can watch the funds roll in. Here’s the Bitcoin address, where $4.3M in bitcoin has been received as of midnight ET on the 28th of February.

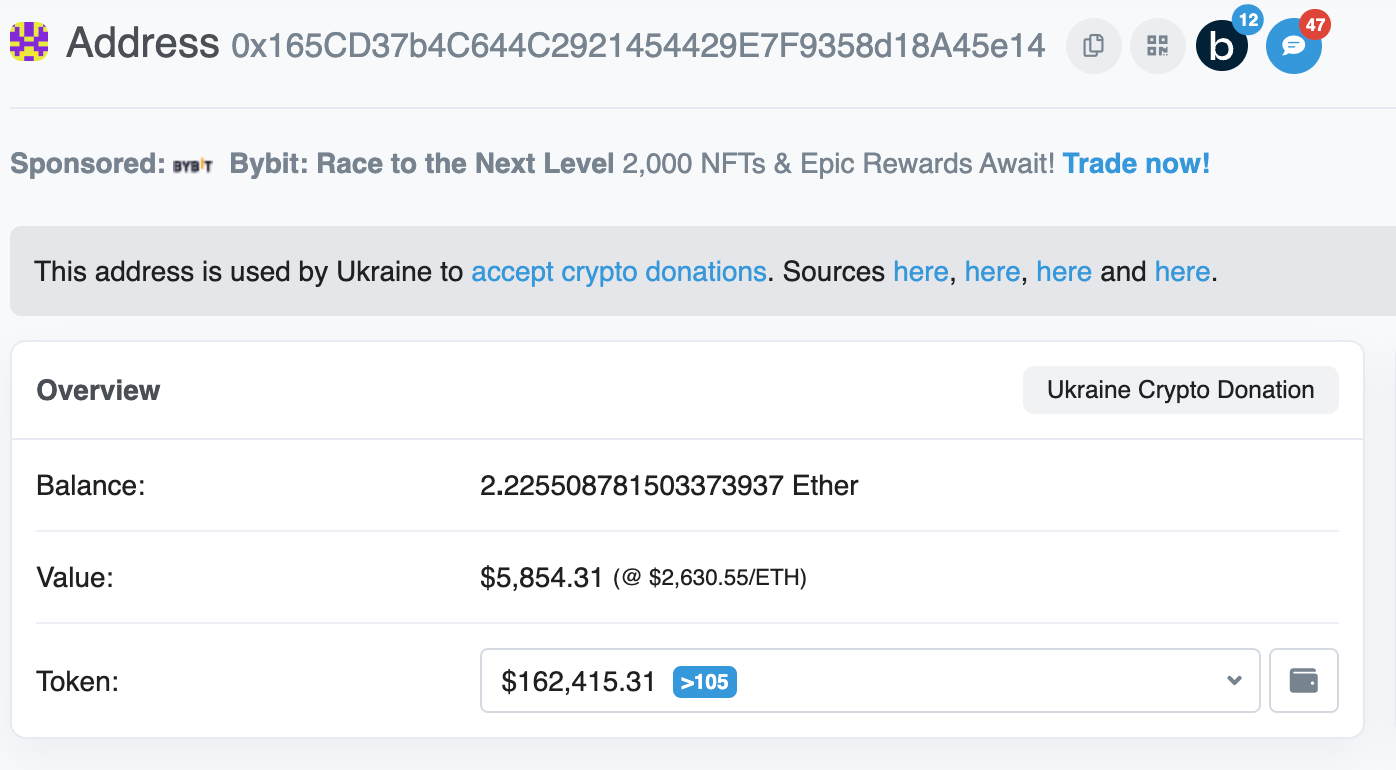

And here’s the Ethereum address where $6M has been received.

I’m sharing these with you as proof that the calculus of war has just shifted. For the first time in human history, resources from around the world can be sent directly to help a nation defend itself — no intermediaries necessary. I sincerely doubt that Putin counted on this occurring.

Crypto is a weapon of defense — it was a munition guarded by the US Department of Defense until the 1990s. Humanity is witnessing the reason for this as we speak. For those of us who have drunk the kool-aid, we’ve recognized it is the greatest chance humanity has at arriving at global peace. Not that interpersonal violence will disappear, but the ability for a nation to wage war on another country can only occur through the money printer ginning up more money. National violence peters out without the funds to sustain itself. Having a world where the reserve asset is impossible to inflate will deflate the ego of the maniacal leader hellbent on securing his (it’s ALWAYS “his”) legacy through the bloodshed of others.

But crypto is not just a weapon of national defense. It’s also a weapon of personal defense, as the citizens in Canada have discovered in the last couple of weeks, realizing that the banks control their money, not the people who own the accounts. And banks can be deputized by governments. The number of Canadian tweets I’ve seen showing people pulling out stacks of cash moving it into Bitcoin is astounding.

For the first time in human history, citizens can opt-out of their governmental fiat money and opt into a system outside governmental control. A person’s wallet may become known, but the government can’t seize it. And therein lies the defense: it’s a choice by each person where and when they will send their Bitcoin. Governments can coerce people to send them their Bitcoin, but no longer can they SEIZE it. Over a long enough period, that distinction shifts the balance of power towards people and away from governments — think what life will be like when individuals choose to pay their taxes.

After the debacle of the pandemic and failed wars, where countless lives continue to turn to dust, it’s tough to think that it’s a bad thing to shift the balance of power away from governments and towards people. Maybe, just maybe, we’ll prove John right.

Imagine all the people

Sharing all the world— John Lennon

Rad Things on the Interwebs

Nope, I can’t see Russia or Ukraine from here.

Bitcoin Price Prediction

Weekly Range: $28k - $40k

Last week's price printed lows down to $34.3k, just below my low range prediction at $35k. It was immediately bought up, closing just above $38k. Since then, the price has gone sideways and is currently trading close to $38k. With war now squarely on the table and Bitcoin being in the middle of the dialogue, I suspect volatility will continue this week. To remain on the bullish side of things, we want to see the month of February close over $37k, which is just one short day away from occurring. That sets the stage for a potentially bullish March, though a weekly close below $36k could set the stage for a test as low as $28k. All in all, this continues to be a complicated situation for the price, as it’s facing tremendous bearish momentum, though it’s thus far failed to break down. To make it simple, a daily close below $36k would be bearish, while a daily close above $39k gives the bulls a shot at continuation.

Bitcoin Q & A

Q: Will Russia adopt Bitcoin?

A: Eventually.

There’s a lot of speculation that cutting Russia off from the SWIFT transaction system will lead them to adopt Bitcoin. The SWIFT transaction system is a messaging system developed in 1979 that runs most global USD banking transactions. The data centers belong in the US, Switzerland, and the Netherlands. So effectively, it’s a US-Europe consortium. Cutting Russia off from SWIFT will force them to use an alternative, though I suspect it unlikely to be Bitcoin… at least not initially.

Do you have questions or Ramble topics? Leave a comment or reply to the newsletter to reach me.

Bitcoin donations accepted